Benefits To Monetary Planning

Benefits To Monetary Planning

Blog Article

Retirement preparation is among those things that tend to get tossed on a regular basis onto the back burner for lots of couples young and old. Getting finances in order can be a difficult topic to go over with your loved one particularly if it is a sensitive topic. There a number of reasons a person or couple should not wait any longer to sit down and prepare out their strategy in order to retire comfortably.

Action # 6: Stock Your Insurance. While there are numerous kinds of insurance coverage the type we are interested in here are life, medical, special needs and long-lasting care.

As the world changes so do the guidelines. Lots of decisions that are being made today are going to have far reaching impacts on retired people. Have you considered how you may be effected or are you doing the "ostrich thing" and burying your head in the sand and simply wanting and hoping?

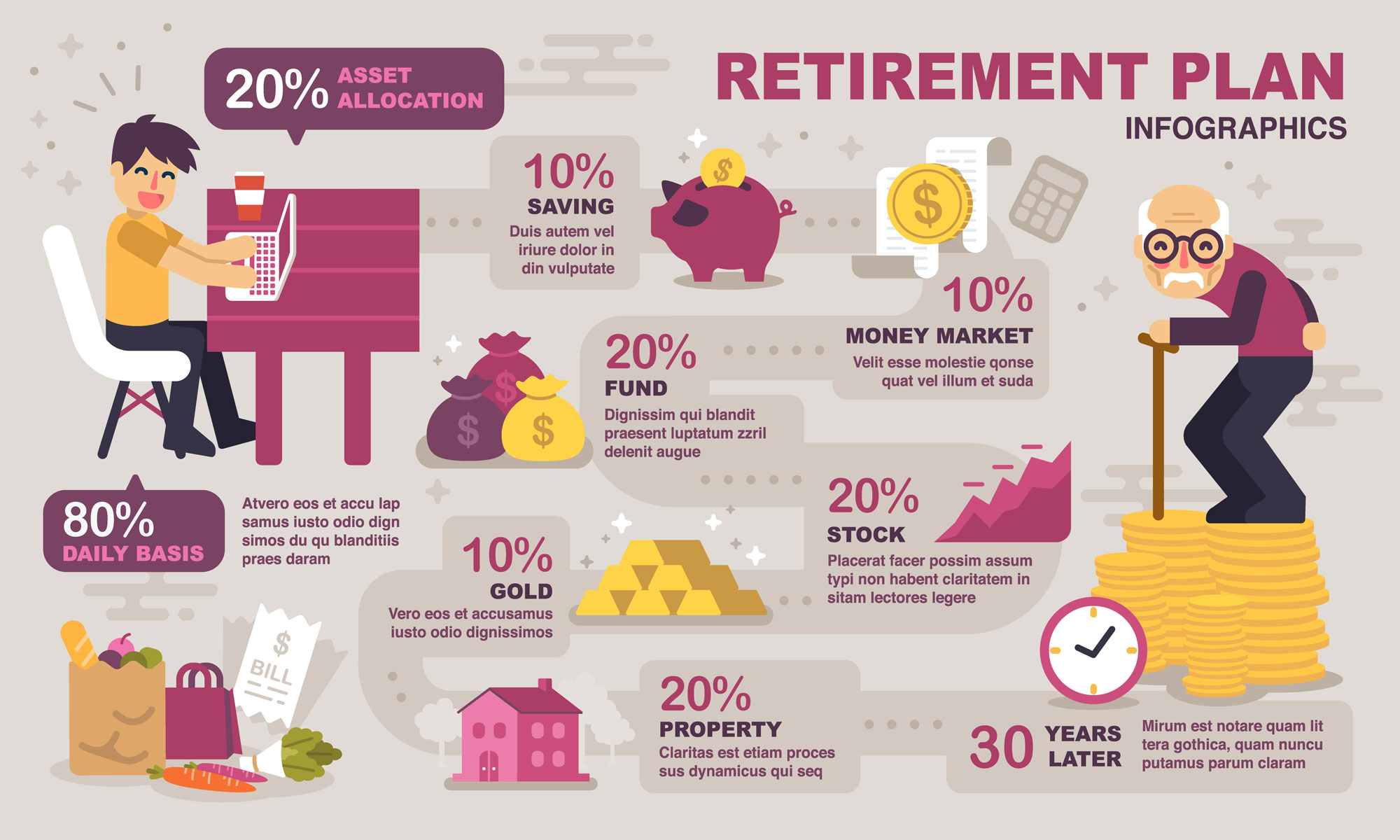

Nothing is colder and lonelier than old age. Being financially self sufficient can give a great deal of warmth in all respects, emotional, social and familial. There is honey if there is money. There is a stats about retirement planning. To take pleasure in a minimum of half the luxuries that you delight in today, you require to save at least quarter of your income for the retirement. This is considering today rate of inflation. Yes it is a bit optimistic. However if we might conserve half of what is ideal it would give us a firm assisting hand.

Research studies reveal that there are 60 million working females out there and a little less than half are registered in a retirement plan. It will be difficult to have a retirement fund if there are no contributions to it.

If you're business uses a 401k retirement plan it's a lot more sensible to begin early. Many companies use a company match for your 401k strategy contributions. This implies that for every dollar you contribute, they'll frequently match that dollar for dollar, up to a specific limitation. So, at least you should make use of a 401k plan approximately the company retirement strategy match. This is easy money, as you'll be getting an one hundred percent return on your money, right off the bat. Where are you going to get those returns? The response, is not anywhere without a lot of risk. You can then add that one hundred percent to any market returns you capture gradually. And the beauty of everything is a $100 deduction out of your payroll will seem like less since it's pre-tax. All these benefits truly make starting a 401k plan a no-brainer.

Rate of interest are being manipulated by devious political leaders. Today they are so low that it takes a large quantity of cash to produce a reasonable retirement income. If you have $1 million conserved, and you earn interest of 2 percent you'll earn $20,000 every year. Enough to fund only a penny-wise retirement.

The truth is that the way of life you can pay for in retirement largely depends upon you. How diligently you conserve. How carefully you browse today's challenging markets. And, most notably, how realistic you retirement education remain in the presumptions you make about your retirement planning. Your best choice before you proceed and start putting the numbers into a retirement calculator is to address some really crucial questions about those assumptions and the life you hope to live.

Report this page